I am going to be very boring and paste in my messages on the topic from TG Main.

I have copied in a couple of other people’s comments for context.

I hope I have correctly identified them here.

–

Wow, that’s quite some news

I hadn’t expected that

But exchanges only make money by being exchanges and volume way down.

But now I see the story has moved on.

Oh well, never up-to-date in crypto

Too fast

Sums too vast

–

So kept reading down and found:

Ceterum autem censeo KYC/AML esse delendam

Moreover, I think Carthage should be destroyed. — Cato The Elder

–

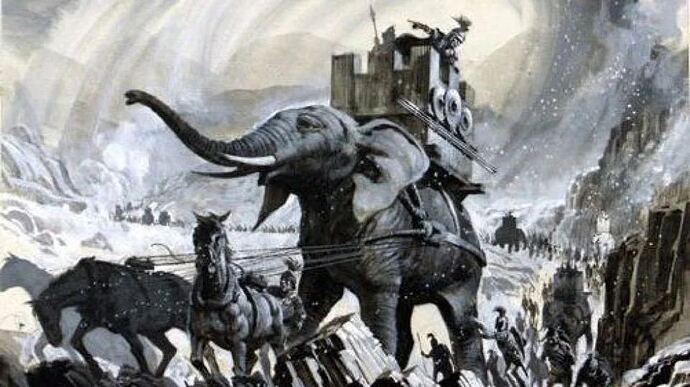

I just want to say something about elephants here.

Alexander the Great died in battle 323 BC.

Hannibal — in the picture, crossed the Alps 218 BC.

Hannibal was successful until the Romans took the battle to Carthage 204 BC.

So, Alexander the Great, even though the Macedonians (who one hundred years later battled with Rome from the East and supported Hannibal) had beautifully carved ivory, at this time, they did not know that the ivory came from elephants.

Alexander the Great was overwhelmed in the East, fighting against armies mounted on these animals. His easternmost point of conquest was at the Beas River, in the Punjab, where his troops mutined, so they then turned back.

Oh, by the way, where did Alexander the Great eventually die?

In Babylon (about 150 km from Baghdad as it happens).

It is remarkable that wealthy people could have in their possession beautiful artefacts made out of a material from an animal they had no idea of.

And that same animal should go on to play such a pivotal role in their history, not once, but twice.

So let’s talk about elephants.

Elephants in rooms.

The thing is that, obviously, any amount of tokens can be created when designing a token.

XRD has a certain and circumscribed function — there remain questions about this.

Those developed on top may also have certain circumscribed functions — the questions that have to be asked about these cannot be quite the same as those asked about XRD, I think.

I do not think that “magic money creation” is necessarily economically wrong.

I am unclear about what are the conditions that make it a favourable activity, but it seems (in the most general way I can think of this) to be where it represents limits to the reaches of agreed human behaviour and collective endeavour.

Theory 1: If the behaviour persists in what is an agreed and agreed verified desirable way, the coin holds the value for this. If not, the coin begins to lose its value.

So what about Alameda, FTX, FTT, Binance, BNB and the two players SBF and CZ?

Well, one thing, while BTC and ETH are down down down, BNB is up against them 8.95 and 15.94, respectively.

What about the vulnerabilities of XRD?

Couldn’t CZ simply monopolize a huge amount if they so desired?

Or buy and dump only to repeat the cycle as the price plummets?

Is this a particular vulnerability of the arrangement I outline in Theory 1?

I don’t want to be defeated by an elephant in the room.

–

James You, [9 Nov 2022 at 07:05:41]:

Don’t be afraid.

We are experiencing the downfall of FTX and Solana.

we are learning

About the true value of Radix

–

I reply:-

Although these are serious issues.

People lose money. Effort goes to waste.

Ok it’s the market.

Also @TheCodeisTheLaw, the elephant is still in the room.

Something to do with the economics entailed in decentralisation of a token with ascribed value and the market.

The series of mechanisms where that value is established at any moment of exchange.

–

THis, [9 Nov 2022 at 14:33:46 (9 Nov 2022 at 14:38:32)]:

But as to more historical figures, different figures teach us about history in different ways.

For what I just wrote, I was just reading up on Wikipedia after something sparked me off.

So I am not in-depth about such things.

But I am wanting people to take it as a metaphor.

This is one of the values of history.

People say it repeats itself. But I think it shows that there are necessary human limitation and, of course, for anything to “happen”, there are other people involved.

These are fundamentals. Other people with our (ultimate) limits, us and them.

DeFi can help define us and them differently if we are so-minded.

It needs thinking about.

In terms of history, I am interested in ancient history but very much someone who doesn’t dive deep into reading up on it.

A few months ago, my partner Patricia and me were in Thessaloniki for an interesting family reunion which takes place every three years, except for Covid.

When I say family, I mean the extended family that would never have gathered had it not been for the internet and being able to afford airfares! Yes, there is a family connection.

So we had an intense time being guided around various sites and being introduced to some history, both ancient and more modern.

One of the things that came up — I think I asked the question of our guide — was how it was in the time of King Philip, they had ivory carvings, but his son, Alexander the Great, didn’t know about elephants.

Moving sideways a bit, I don’t suppose I am the first to observe this about the ancient world’s relationship to elephants at all.

I think that Hannibal adopted them and there must be a history to that, quite possibly influenced by what happened to Alexander.

So elephants were their secret weapon — although I believe he hadn’t reckoned with the difficulty of getting elephants through the alps. They tend not to like the cold!

I believe when he was called back to Carthage, this is the reason he had to make further ingress through what is now Italy and find a port from where they could be transported.

He depended on technology, by the way. The technology of knowledge of how to sail from that port to Carthage. OK, a well-known destination, but still needed navigation.

We may be (re)inventing the very brilliantly conceived symbol-reader, the alethiometer.

THis, [9 Nov 2022 at 14:37:24 (9 Nov 2022 at 14:42:55)]:

Do we know?

This needs to be built, but perhaps we can do better than what is available so far.

I notice that many DEX have different tools to try to make the casual investor more at home and the serious investor give help with their research.

But perhaps that is only the beginning of what can be done in the space for this use case.

–

THis, [9 Nov 2022 at 18:01:43]:

Alethiometer | His Dark Materials | Fandom

The alethiometer, nicknamed the symbol-reader, was a compass-like device that was used to communicate with Dust and find truthful answers to one’s questions. Only six alethiometers were ever made…

THis, [9 Nov 2022 at 18:01:43]:

What is an alethiometer used for?

The alethiometer, nicknamed the symbol-reader, was a compass-like device that was used to communicate with Dust and find truthful answers to one’s questions. Only six alethiometers were ever made. The name of the object comes from the Greek aletheia (truth) and meter (measure).

Alethiometer | His Dark Materials | Fandom

There is a question of how Philip Pullman invented this with such prescience in 1995?

It’s interesting that he places the golden compass or alethiometer in the hands of only certain figures (Lyra Silvertongue) who know how to read it.

Where as, the alethiometer of the DLT should be amenable to be understood by anyone.

Or should it ?

Or it is all fantasy?

Northern Lights, published as The Golden Compass in Northern America and certain others countries, is the first novel in the His Dark Materials fantasy trilogy by the British writer Philip Pullman. First published in 1995

–

THis, [9 Nov 2022 at 18:03:30]:

Don’t be sure it is only SOL. The contagion and unearthing of secrets may have far further to go.

–

THis, [10 Nov 2022 at 19:59:31 (10 Nov 2022 at 19:59:57)]:

There is a detailed breakdown of it here, from Kaiko research:-

https://marketing.kaiko.com/the-ftx-collapse-a-market-analysis

“FTT is now virtually worthless, the exchange token for an exchange with a multi-billion dollar hole in its book. The token is down nearly 90% in the past week, now trading at under $3, with a fully diluted valuation of just over $1bn.

Unfortunately, the damage from this market collapse spread far and wide due to the importance of FTX and the tangled web of investments that Alameda Research supported using the FTT token.

The cascading effects of the FTX/Alameda will take months to play out and are too numerous to cover in a newsletter. But let’s start with FTX itself and then expand into Alameda and broader impacts. “

Daxter, [10 Nov 2022 at 20:02:41]:

I think all the signs where there, Coffeezilla had a video on SBF describing crypto as a ponzi scheme a few months ago

THis, [10 Nov 2022 at 20:03:27]:

“FTX is now purgatory, with all funds on the exchange effectively turned into Monopoly money or legal claims, depending on your time horizon. Market makers and retail users alike are trapped on the exchange, cut off from the rest of markets and left to develop its own biosphere.”

…

“Alameda had long been involved in the Solana ecosystem and had developed a reputation for investing in projects with massive fully diluted valuations and small market caps, which allowed them to profit while early retail investors were crushed.”

THis, [10 Nov 2022 at 20:06:12]:

Yes, the signs were there, and it seems to me they were not surfaced properly.

—

“Cryptocurrency exchanges have long issued their own tokens, which generally have few benefits beyond giving holders discounts on trading fees, but have rarely received scrutiny. As described in FTX’s FAQ section, here is FTT’s utility:

The more we learn about FTT, the more it seems that this concocted cryptocurrency underpinned a significant portion of the FTX/Alameda empire. The token has (had?) extremely limited utility, but it was used extensively as collateral: in DeFi, inside FTX, and on the books of Alameda.”

I think it is reasonable to expect industry watchers, Kaiko perhaps, to pick this up.

If a coin has no utility, if it is not tied to reality, this presents a risk.

I am not experienced enough, nor do I have the expertise, to make this sort of analysis.

But I am worried about coins that float on top of Radix. I don’t really understand the mechanisms.

It is not enough to say the market will sort because the market has to be fed with accurate and comprehensive knowledge.

If I become known as the bottle milkman, I don’t care, but where is the bottle of milk? i.e. the actual utility in the transaction out of the ecosystem?

–

Markus, [10 Nov 2022 at 20:13:37]:

Alameda has invested in the projects, and FTX has provided the exit liquidity.

A duo the crypto world is better off without in the long run.

THis, [10 Nov 2022 at 20:18:55]:

In FTT.

What I’m saying is that this must have been obvious:

“The more we learn about FTT, the more it seems that this concocted cryptocurrency underpinned a significant portion of the FTX/Alameda empire. The token has (had?) extremely limited utility, but it is was used extensively as collateral: in DeFi, inside FTX, and on the books of Alameda.”

exit liquidity ≠ utility

I would like to be enabled to understand the economic mechanisms of Radix & ecosystem.

Preferably in an adjustable chart with knobs and dials.

Daxter, [10 Nov 2022 at 20:31:43 (10 Nov 2022 at 20:44:28)]:

Everything would’ve been fine if people left their money on the exchange, but as soon people started pulling out is when everything went downhill, they were operating just like how a bank operates by putting other peoples money to work and over-leveraging, it could happen again, the question is, can this sort of thing have happened on a decentralized exchange?

Markus, [10 Nov 2022 at 20:37:24 (10 Nov 2022 at 22:14:19)]:

Adam Cochran (adamscochran.eth)

Let’s correct some confusion on bank runs.

A “bank run” happens because banks have partial reserves, because they use your money to invest for profit.

Even a competitor cannot “cause a bank run” on a 100% reserves entity.

Which according to FTX’s ToS they should be:

Markus, [10 Nov 2022 at 20:37:24 (10 Nov 2022 at 22:14:19)]:

Normally not. Although it would be theoretically possible (as far as I know).

By the way, a bankrun wouldn’t have bankrupted FTX if FTX had followed their own ToS. But it seems they have become greedy.

https://twitter.com/adamscochran/status/1589977554429292545

–

Well there are other kinds of leverage.

–

THis, [11 Nov 2022 at 13:57:43]:

Subscribe to read | Financial Times

News, analysis and comment from the Financial Times, the worldʼs leading global business publication

THis, [11 Nov 2022 at 13:57:43]:

Further write up of #SBF #FTX #FTT found in #FT and #Cointelegraph

https://www.ft.com/content/b2b60629-953c-4fd8-bebf-2a0c78ecfe4b

Irony of Risk Appetite and Achilles heels: Two problems

“

Crypto’s future may be divided, not dead, Gillian Tett

…

Indeed, the sector is a key example of how investor risk appetite has been hurt by central bank tightening (which, as I have noted before, is ironic given that crypto was billed as a hedge against central bank excess).

—

For the FTX implosion has revealed that the sector has at least two big Achilles heels.

One is that it is fiendishly difficult to know what assets underpin digital tokens (other than blind faith) since balance sheets are often opaque. FTX and Alameda used to be considered well-capitalised.

—

The second issue is custody, where practices have long been a dangerous mess (as I also recently warned). The SBF empire was simultaneously a broker, proprietary trader, lender and custodian for the crypto world, reportedly rehypothecating assets on a large scale.

“

Existing oversight in California

https://cointelegraph.com/news/california-regulators-to-investigate-ftx-crypto-exchange-collapse

“

The Department of Financial Protection and Innovation (DFPI) in the state of California announced on Nov. 10 that it will open up an investigation as to the “apparent failure” of the cryptocurrency exchange FTX.

California regulators said in the announcement that the DFPI takes this oversight responsibility “very seriously” and that the department expects all entities offering financial services in the state to comply with local financial laws.

“

https://cointelegraph.com/news/us-senators-commit-to-advancing-crypto-bill-despite-ftx-collapse

Drive to Regulation from California

“

The two U.S. Senators said the downfall of FTX clearly exemplified “the need for greater federal oversight of the digital asset industry.”

—

But the members of the U.S. Senate Committee on Agriculture, Nutrition and Forestry confirmed their intentions in a Nov. 10 statement — stating, “the events that have transpired this week reinforce the clear need for greater federal oversight of the digital asset industry.”

“

Rumors

“

The crypto community continues to be bombarded with rumors and conspiracy entering into the fifth day of FTX’s fall.

From reports that Sam Bankman-Fried (SBF) was arrested on the tarmac at the Bahamas airport to rumors that employees of the exchange are trying to sell the company’s assets, it has been very difficult for the community to separate fact from fiction.

PAULY.SOL, the founder of the nonfungible token (NFT) project Not Larva Labs was one of the first to spur rumors of SBF’s arrest.

“

We know this about farming loans and farming.

There are things to watch out for.

Dangerous things in terms of multiplying risk.

What happens in trad is not so clear cut, and we are all affected by it anyway.

It’s where we live at the moment. I don’t really see that changing, so better understand where we are, not where we would like to imagine we should be.